|

Get a Quote

|

WALSH PURE SPREADER - Pure Hedge Division

WALSH PURE SPREADER Pure Hedge Division RICH MORAN 10/3/2025

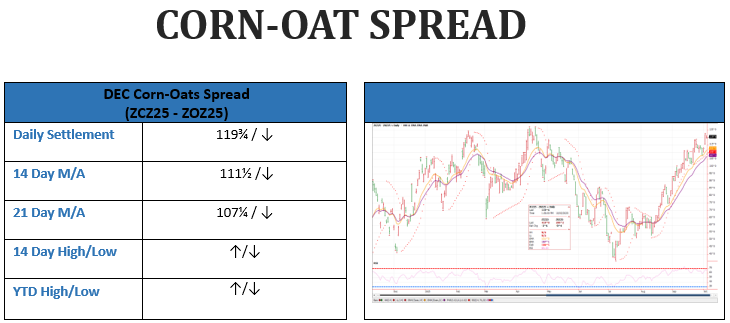

DEC Corn-Oats Spread (ZCZ25-ZOZ25) Most of my recent trade suggestions in the grain spreads have been buys and somewhat bullish for the grains. I have been looking for a way to more comfortably slip some shorts in the corn market into our position. I think there might be some possible value if we can find the right place to sell Corn over Oats. More specifically, sell DEC Corn (ZCZ25) and buy DEC Oats (ZOZ25). This would be selling the ZCZ25-ZOZ25 spread. This spread has not settled below either the 14-day or 21-day moving averages since 8/14/25. It has not even traded below either of these moving averages since 8/18/25. It has gotten very close many times, but it has not been able to trade below the apparent support of either the 14-day or 21-day moving averages. I think if we can break through this support and trade below, as well as settle below, both of these moving averages, this support could turn into resistance. At this point, it might be a good time to get short the ZCZ25-ZOZ25 spread (sell ZCZ25 and buy ZOZ25). Then, I would suggest having a short stop above its recent 5-month high of 122. We can choose our exact risk/reward levels if and when we put this position on. If you have any thoughts/questions on this article or any questions at all in regard to the commodities futures markets, please use this link Sign Up Now Following up on the still active past trade ideas:

Today’s settlement: .48, Long at .42 On Wednesday (10/1/25) I said “I think it might be a good play to bid today’s settlement (42 cents) or better when the corn market opens.” “If we get filled, risk 24 cents (18) or $268.80 Per Spread to make 50 cents (92) or $560.00 Per Spread plus fees and commissions.” Yesterday (Thursday, 10/2/25) the market opened at .41, so we are long at the SBH26-SBK26 spread at 42. Risk 24 cents (.18) or $268.80 Per Spread to make 50 cents (.92) or $560.00 Per Spread plus fees and commissions.

Today’s settlement: -18¼, Long at -14½ On Wednesday (9/24/25) KEZ25-ZWZ25 settled -12¾. I suggested placing an offer to buy KEZ25-ZWZ25 at -14½ on Thursday (9/25/25). The spread traded -15, so we are long at -14½. Risking 8 cents (-22½) or $400 to make 24 cents (+9½) or $1,200 plus fees and commissions.

Today the spread settled 96¼, below the 14-day that settled 97 and the 21-day that settled 99½. If we can get the ZWZ25-ZCZ25 spread to trade and settle above the 14-day and 21-day moving averages, I think getting long this spread with a relatively short stop could be a good play. I believe this might offer us a nice risk to reward trade. I think we should risk about 15 cents or $750 Per Spread to make about 50 cents or $2,500 Per Spread, plus fees and commissions.

Today’s settlement: -.21, Long at -.20 This is purely a Full Carry Comparison trade suggestion …. On Friday (9/12/25), I suggest trying to get long the ZLF26:H26:K26 butterfly on Monday at Friday’s settlement of -.20 or better (buying the JAN-MAR Soybean Oil spread .20 below where you sell the MAR-MAY Soybean Oil spread). Monday opened at -.20 and that was the high, so we are long at -20. Risking 5 tics (-.25) or $30 Per Spread to make 20 tics (00.00) or $120. Per Spread, plus fees and commissions.

Today’s settlement: -16¾, Long at -17½ On Wednesday (9/10/25) I suggested that if the ZCZ25-ZCH26 opens at -17½ (Wednesday’s settlement) or higher, trying to get long the spread (buying Dec25-Corn versus selling Mar’26-Corn) at -17½. The spread opened at -17½ and traded lower, so we are long at -17½. Risking 2 cents (-19½) or $100 Per Spread to make 6 cents (-11½) or $300 Per Spread, plus fees and commissions.

Today’s settlement: 132.050, Short at 139.900 On Friday (9/5/25) I suggested trying to get short the LEV25-HEV25 Spread at 139.900 or better on Monday (9/8/25. We were able to sell the spread at 139.900 on Monday. Risking 6.000 (145.900) or $2,400 Per Spread to make 18.000 (121.900) or $7,200 Per Spread, plus fees and commissions. 9/12/25: we moved our stop down to our entrance price of 139.900 for a scratch. I never like to turn a winner into a loser.

We were looking for this spread to get back above and settle above the 14-day and 21-day moving averages. I think we should try buying the spread with a short stop below these moving averages. Yesterday (10/2/25) this spread, ZSF26-ZSN26 (JAN-JULY’26 Soybean Spread), settled above both the 14-day and the 21-day moving averages at -39. I suggest buying the spread at -39 or better when the Soybean market opens next week. If you do not get filled on the opening, work a -39 bid. If and when/where you get filled, Risk 6 cents or $300 to make 18 cents $900 Per Spread, plus fees and commissions.

Today’s Settlement: -19, Long at -17½ The spread settled above the 14-day and the 21-day at -17¾ on 8/21/25. You should be long at -17½ from the open on 8/22/25. Risking 3½ cents (-21) or $175 to make 9 ½ cents (-8) or $475

Today’s Settlement: -17¼, Long at -18½ Risking 3½ cents (-22) or $175 Per Spread to make 10 cents (-8½) or $500 Per Spread, plus fees and commissions. If you have any thoughts/questions on this article or any questions at all in regard to the commodities futures markets, please use this link Sign Up Now Rich Moran Senior Commodities Broker Direct: (312)985-0298 Cell: (773)502-5321 Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member. This article contains syndicated content. We have not reviewed, approved, or endorsed the content, and may receive compensation for placement of the content on this site. For more information please view the Barchart Disclosure Policy here.

|

|

|