|

Get a Quote

|

Crucial climatological factors that influence winter weather and natural gas prices

(NGX25) (NGZ25) (NGF26) (TGX25) (NFX25) (UNG) (KOLD) (UNL) (BOIL) “Crucial climatological factors that influence winter weather and natural gas prices”

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter Edited by Scott Mathews

For full FREE reports about commodities and the weather’s impact, please subscribe to our newsletter on Substack by clicking the link below: https://weatherwealth.substack.com/  Currently, strong LNG exports for natural gas and a warmer-than-normal late summer have helped natural gas prices. As we head deeper into the autumn for the Northern Hemisphere, it is typical that a mostly warm October/November may result in natural gas prices falling (80% of the time, historically). Winter weather patterns will, of course, have a huge impact on both the outright natural gas market and heating oil spreads. Some of the climatic influences on winter weather are:

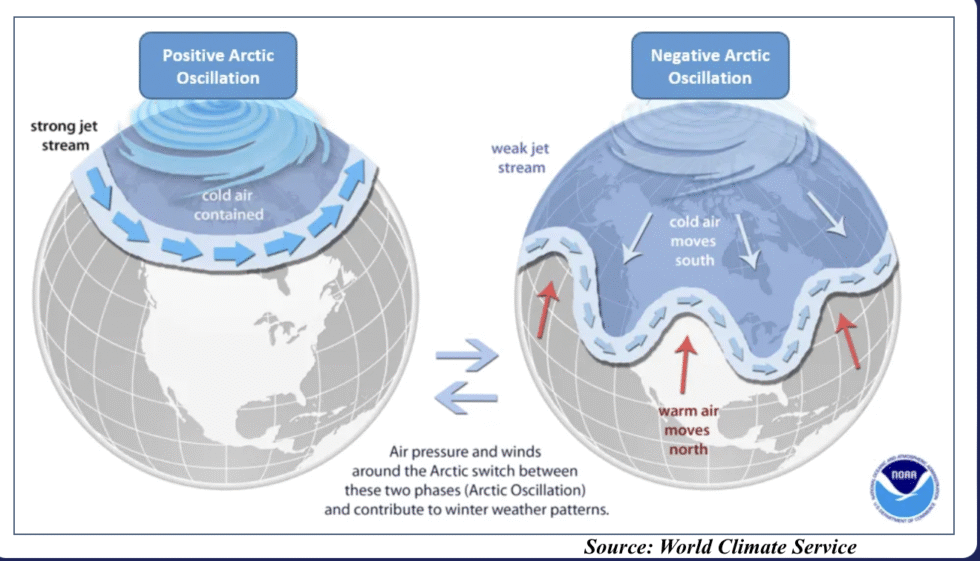

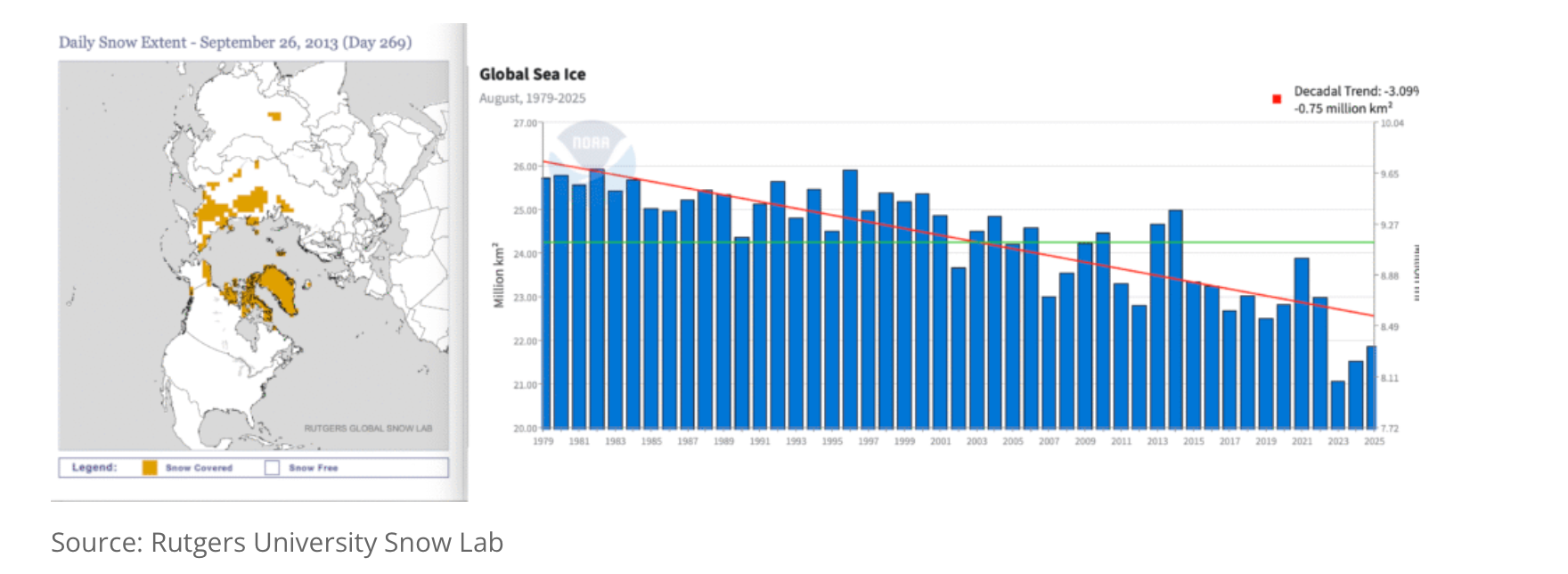

Factors like Arctic sea ice and the extent of Asian and Canadian snow cover by late October and November will affect the Arctic Oscillation index and winter weather. Large-Scale Climate Patterns

This atmospheric pattern is a leading mode of variability in wintertime Northern Hemisphere snow cover. Anomalies in the AO circulation can affect snowfall and snowmelt, but the relationship between the AO and hemispheric snow cover is complex, with regional patterns like the Central/Eastern US and Europe showing a dipole structure. Two preliminary winter studies: Weak La Niña events & Warm USA October trends:

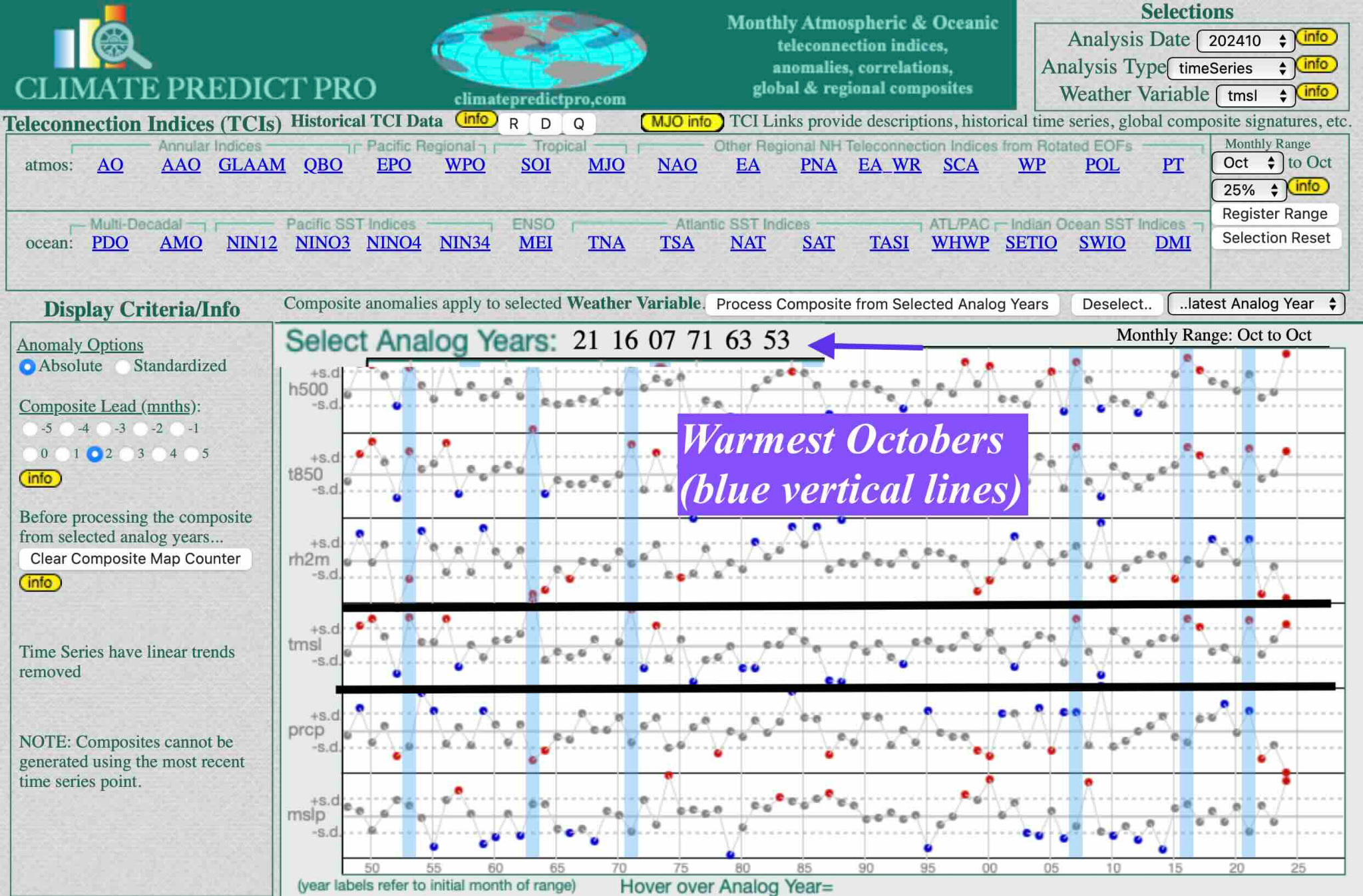

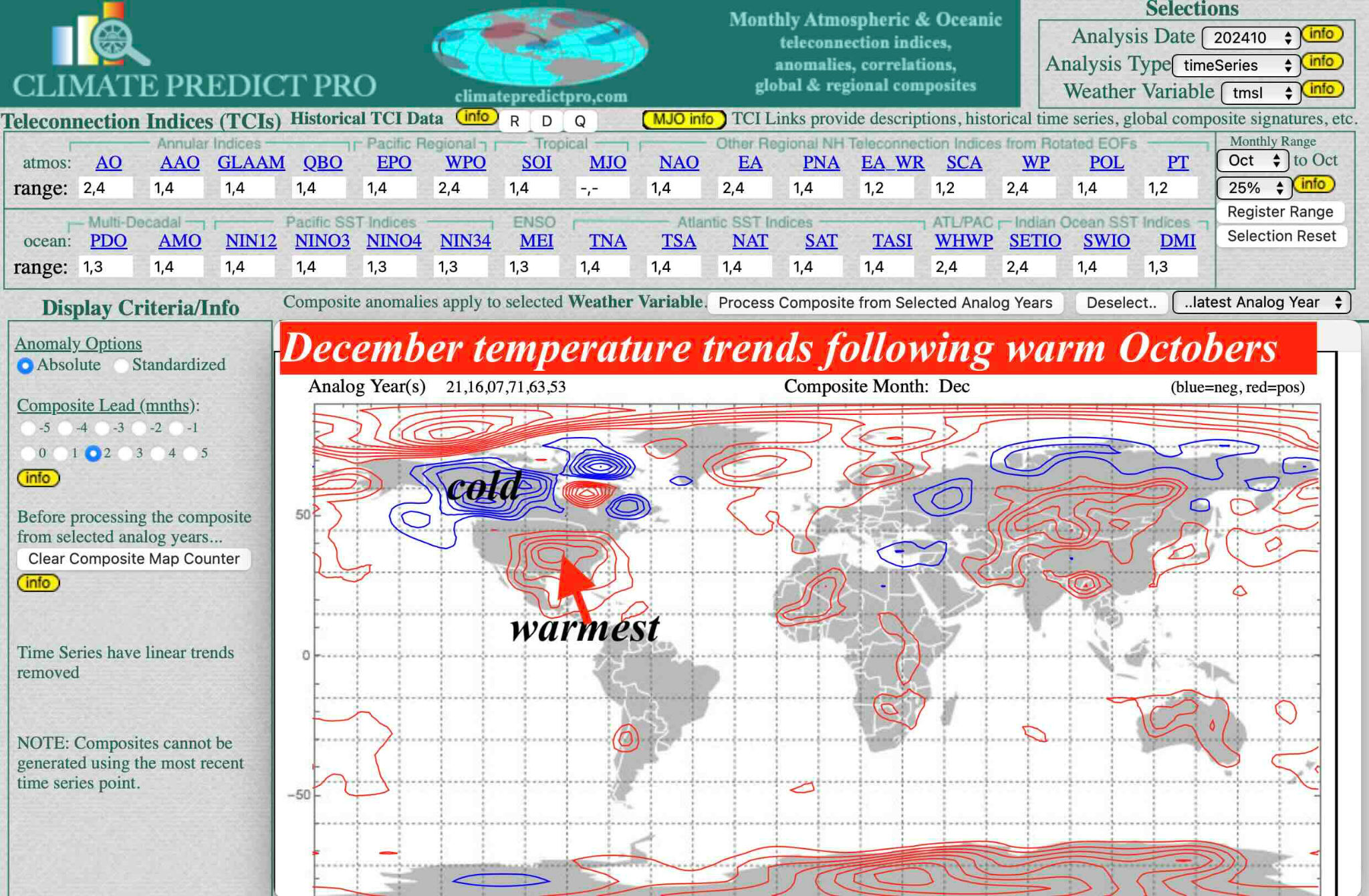

Winters in the U.S. are rarely colder than normal following a warm October. You can see this from my ClimatePredict program:

Source: ClimatePredict (Weather Wealth newsletter) Historical climate analysis indicates that when October is unusually warm, the subsequent winter is colder than normal only about 17% of the time—meaning roughly 1 out of 6 cases.Conversely, about two-thirds (67%) of winters after a warm October are actually warmer than normal, which is significantly higher than what random chance would predict.

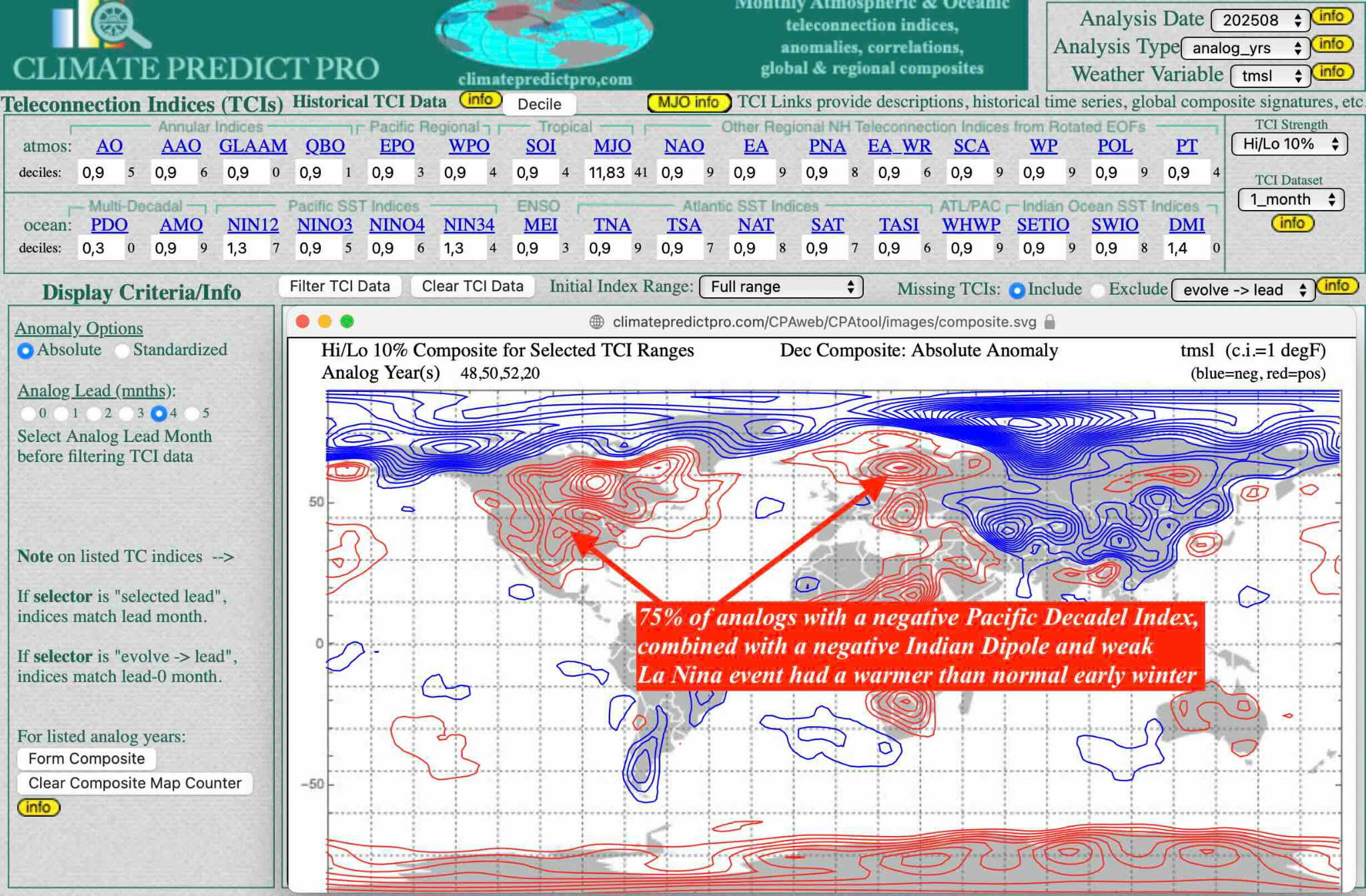

Source: ClimatePredict (Weather Wealth newsletter) La Niña, negative Indian Ocean Dipole (IOD), and negative Pacific Decadal Oscillation index (PDO)The strongest of La Niña events can sink the jet stream further south and create an occasional negative AO index over the Arctic. This can bring great snow and ski conditions to the European Alps.

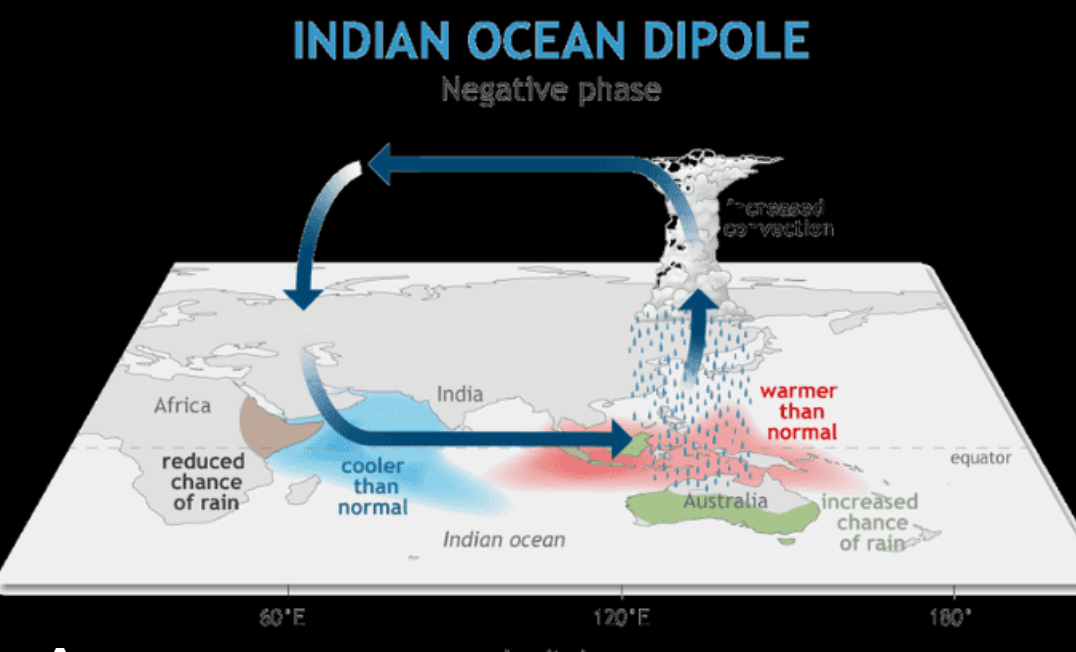

Source: NOAA & ClimatePredict (Weather Wealth newsletter) However, the weaker La Niña events, (when coupled with a negative IOD and negative PDO) often bring warmer than normal early winters across the majority of the U.S. energy demand areas.

Source: NOAA & ClimatePredict (Weather Wealth newsletter) Notice the warm waters northwest of Australia around Indonesia and cooler-than-normal ocean waters east of Africa. This weather pattern helped to improve Australian wheat crop prospects over the last few months (negative IOD).

Source: Australia Bureau of Meteorology For full reports like this, with commodity trading strategies in natural gas, grains and soft commodities, we invite you to request a two week FREE trial period here for $1.  https://www.bestweatherinc.com/membership-sign-up/You can cancel at any time. Find out what we are telling major natural gas producers, futures traders, etc. around the world and our longer term view about the markets. Thanks For Your Interest In Commodity Weather Intelligence !!!Jim Roemer, Scott Mathews, and the BestWeather Team

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He is also a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA-registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he commands a unique standing among advisors in the commodity risk management industry. This article contains syndicated content. We have not reviewed, approved, or endorsed the content, and may receive compensation for placement of the content on this site. For more information please view the Barchart Disclosure Policy here.

|

|

|