|

Get a Quote

|

Walsh Corn Opportunities - Pure Hedge Division

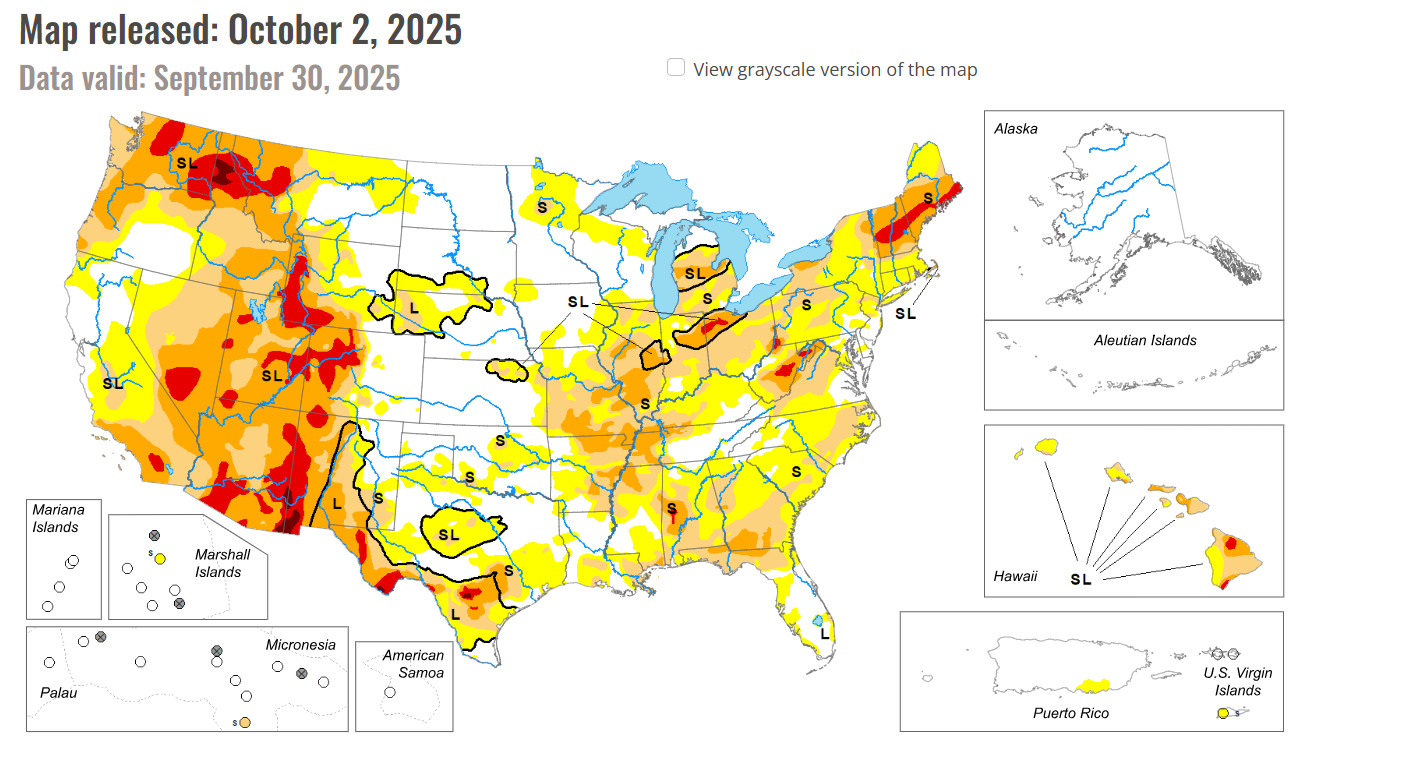

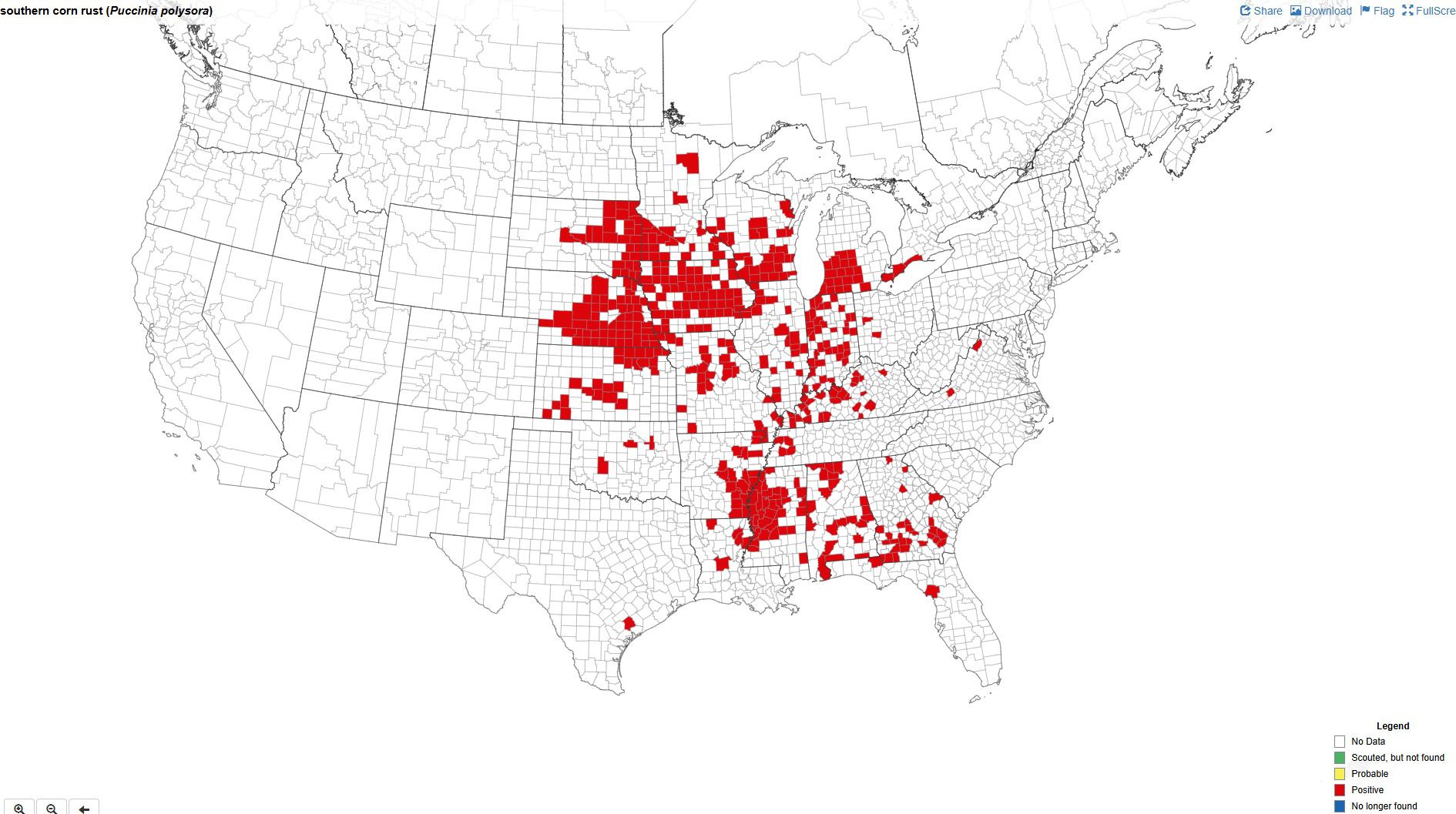

Corn stocks came in at 1.532 billion bushels (bb) on the Grain Stocks report on September 30, compared to the pre-report trade estimate at 1.337 bb. On the September WASDE report, earlier in the month, ending stocks were estimated at 1.325 bb. This shows a 200 million bushel increase in ending stocks above the September WASDE. Last year, the September Grain Stocks report had corn stocks at 1.763 bb. Corn traded as low as 413 after the report but came back slightly over the rest of the day. December corn closed at 419 on Friday. Corn conditions sit unchanged at 66% good/excellent, compared to 64% this time last year. Harvest is at 18% complete, close to the 5-year average at 19%. S&P Global updated its estimate for corn yield to 185.5 bpa, compared to the USDA at 186.7 bpa. Pro Farmer has the most bullish yield estimate at 182.7 bpa.  If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list In 2024, the US sold just over $2 million worth of corn to India. Corn sales to India may increase significantly going forward, as India is reportedly seeking US corn to make ethanol. President Trump stated earlier in the year that he had a goal of completing an India trade deal by the fall. Current tariffs on Indian goods are set at 50%, which were put in place on August 27. A couple weeks back, President Trump tightened H-1B access and Indian delegates raced to D.C. to work on deal negotiations. The UK signed a free trade agreement with India in July and talks with the EU are ongoing. One would think with claims such as “trade wars are good and easy to win” that the pace of trade deals being signed would be quicker than it is, however, more developments could be ahead. This week, Treasury Secretary Bessent said there could be a breakthrough in the next round of trade talks between the US and China. President Trump is expected to meet with Xi in 4 weeks. The deadline for an increase in tariffs on China is November 9. Realized volatility is around 15%, showing the market is waiting on further developments regarding harvest and any demand surprises. Due to the government shutdown, Commitments of Traders reports, Export reports, and the October WASDE will all be delayed. Argentina is expecting a record crop for 2025/26, and the Grain Stocks report offered no relief for those looking for a bounce. A short covering rally could still happen after harvest, as corn has very strong support over $4. The funds will likely take risk off with the lack of information due to the shutdown, consider the trading ideas at the bottom of the article. If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list  Corn area under drought is currently at 28%, compared to 27% this time last year. If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list  The Pro Farmer crop tour in August noted a surprising amount of crop disease on their tour through the Midwest, and it still seems to be an issue. As harvest gets further along this could become a bigger story. The Purdue Plant and Pest Diagnostic Lab reports a 261% increase in corn damage confirmations from 2024 to 2025. If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list December ’25 CORN STRAP Buy 2 December 415 Calls 23 Buy 1 December 415 Put 7 1/2 Price: 30 1/2 Cost: $1,525 Debit/Trade Package, Plus Fees and Commissions. December’25 Corn Options Expire 11/21/25 (49 Days) MAXIMUM LOSS: LIMITED MAXIMUM GAIN: UNLIMITED when price moves upward. LIMITED when price moves downward. This is a volatility strategy consisting of a long position in 2 ATM calls and 1 ATM put. This is a net debit trade. This trade is bullish but can also profit from a large move lower. I think we can see an increase in volatility as harvest continues and there’s more clarity on demand. In addition, managed money traders will likely take risk off with the lack of information coming through due to the government shutdown. December ’25 CORN STRIP Buy 2 December 415 Puts 14 1/2 Buy 1 December 415 Call 7 3/8 Price: 21 7/8 Cost: $1,093.75 Debit/Trade Package, Plus Fees and Commissions. December’25 Corn Options Expire 11/21/25 (49 Days) MAXIMUM LOSS: LIMITED MAXIMUM GAIN: UNLIMITED when price moves downward. LIMITED when price moves upward. This is a volatility strategy consisting of a long position in 2 ATM puts and 1 ATM call. This is a net debit trade. This trade is bearish but can also profit from a large move higher. March ’26 CORN Call me 312-765-7311 If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list Hans Schmit, Walsh Trading Direct 312-765-7311 Toll Free 800-993-5449 hschmit@walshtrading.com www.walshtrading.com Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member. Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71. This article contains syndicated content. We have not reviewed, approved, or endorsed the content, and may receive compensation for placement of the content on this site. For more information please view the Barchart Disclosure Policy here.

|

|

|