|

Get a Quote

|

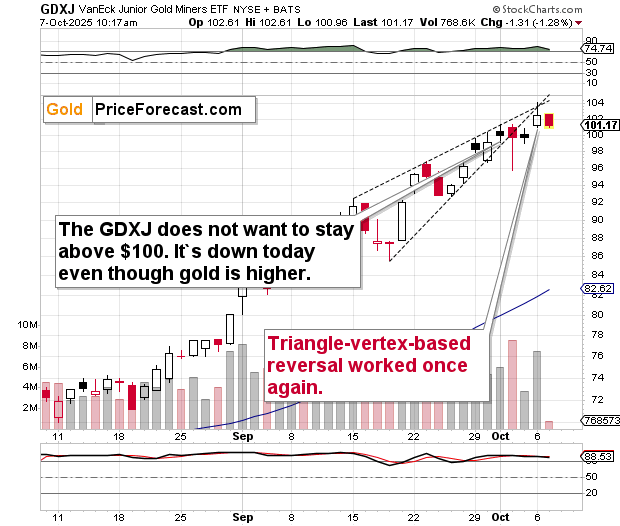

Gold Stocks Refuse to Rally with Gold

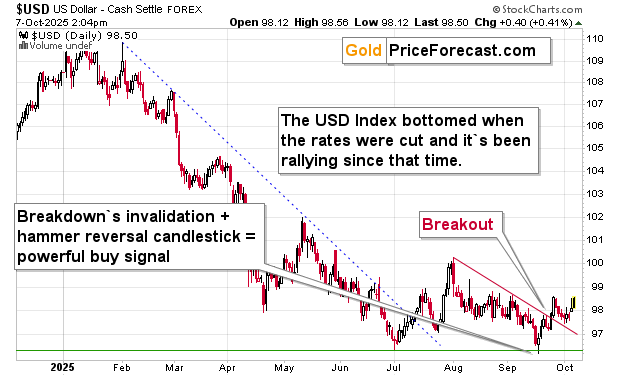

Exactly. The GDXJ ETF, proxy for junior and mid-tier gold/silver miners looks like it’s done rallying, and its move above $100 will be invalidated shortly.  No wonder. We saw a daily reversal, which happened on big volume, and it all took place at the vertex of the lines creating the previous rising wedge formation, which itself was broken to the downside. That’s a sell signal on top of a sell signal, confirmed by a sell signal with another sell signal. And it’s all happening while mining stocks are extremely overbought, and the USD Index is rallying despite extremely negative sentiment and multiple fundamental headwinds. This is an extremely bearish combination for the precious metals mining stocks. Speaking of the USD Index, it’s showing strength after confirming its breakout.  The perfect storm for the precious metals market is brewing. Will gold be able to continue its parabolic upswing? It’s not clear – it recently rallied despite USD’s gains, and the USD – despite moving higher – is not rallying in a way that would be clear for everyone. The latter’s impact on gold could kick in once gold moves even higher. The important thing here, however, is that mining stocks are moving lower even though gold is up. This means that even though gold could rally more visibly in the very near term, miners don’t have to follow it. Just like what we saw recently – their rallies could be small, and their declines could be significant. Just one daily decline in gold could mean a slide in miners from which they would not be able to recover for months. All in all, my previous comments on the USD and PMs remain up-to-date: Yes, the U.S. dollar moved higher after verifying its short-term breakout, which itself happened after it verified its medium-term breakout, and it’s all happening while the USD Index is universally hated, Fed started to cut rates, and the employment numbers are not being published due to U.S. government shutdown. It seems that the USD is able to rally despite everything being thrown at it. This is a massive rally waiting to happen, and the PMs are not going keep ignoring this for much longer. (…) Gold is likely in the final blow-off part of the speculative parabolic upswing, and it’s “doing its own thing”. To be clear – gold didn’t permanently disconnect from the USD. We simply have a moment where it’s moving “on its own” as the rallying prices make it more attractive to other buyers (that’s how investment goods differ from consumer goods, which are less attractive to buyers when they are more expensive). But once the parabola breaks, the slide can and is likely to be huge. And the decisively rallying USD Index is a likely trigger. There can be more of such triggers, though, for example serious turmoil on the job market. Those statistics triggered the 2020 sell-off, and it seems to me that we’re going to see problems there due to either (or more likely both) of the following:

The problem here is that while the job losses in 2008 were temporary, the results of the above could be permanent or at least of medium- or long-term importance. As always, I’ll keep my subscribers informed. Thank you for reading my today’s analysis – I appreciate that you took the time to dig deeper and that you read the entire piece. If you’d like to get more (and extra details not available to 99% investors), I invite you to stay updated with our free analyses - sign up for our free gold newsletter now. Thank you. Przemyslaw K. Radomski, CFA This article contains syndicated content. We have not reviewed, approved, or endorsed the content, and may receive compensation for placement of the content on this site. For more information please view the Barchart Disclosure Policy here.

|

|

|